As November draws to a close, nearly all e-scooter trials that were announced over the summer have been tied up. Operators have been selected, programmes designed, DfT approvals sought. There aren’t many unknowns left, apart from start dates.

So, who has won the burgeoning British market? Before springing to a particular brand name, hold that thought. The picture is actually far from clear. Here are three charts to help.

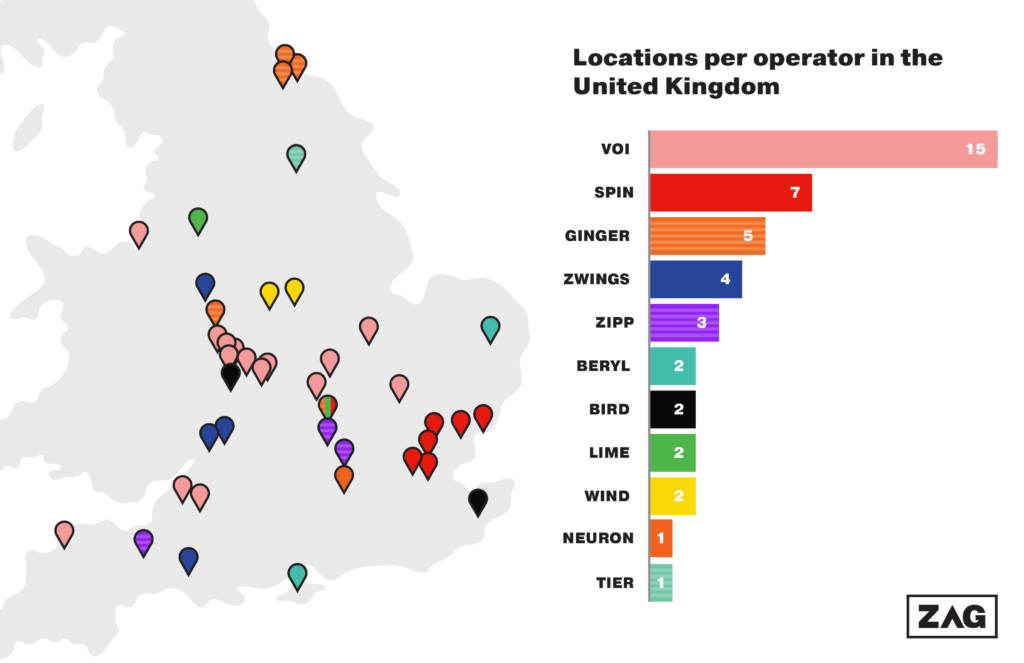

1: Total locations won, by operator

You’ll have seen a version of this chart before. This is simply the updated edition, reflecting a few additional location wins.

The story is the same: at first glance, Voi is the clear victor, dominating the number of trial locations.

However, there are some caveats with this data. These locations are places that have been announced, but not all are live. In fact, there are a huge number which are very, very quiet, giving no indication at all of actually rolling into action anytime soon. One, famously, got paused five days in and will not look nearly the same when it resumes.

It must also be noted, too, that many locations can come under the umbrella of a single project. That means that the number of locations does not equal the number of tenders won. You’d like to see such a graph? Well, you’re in luck.

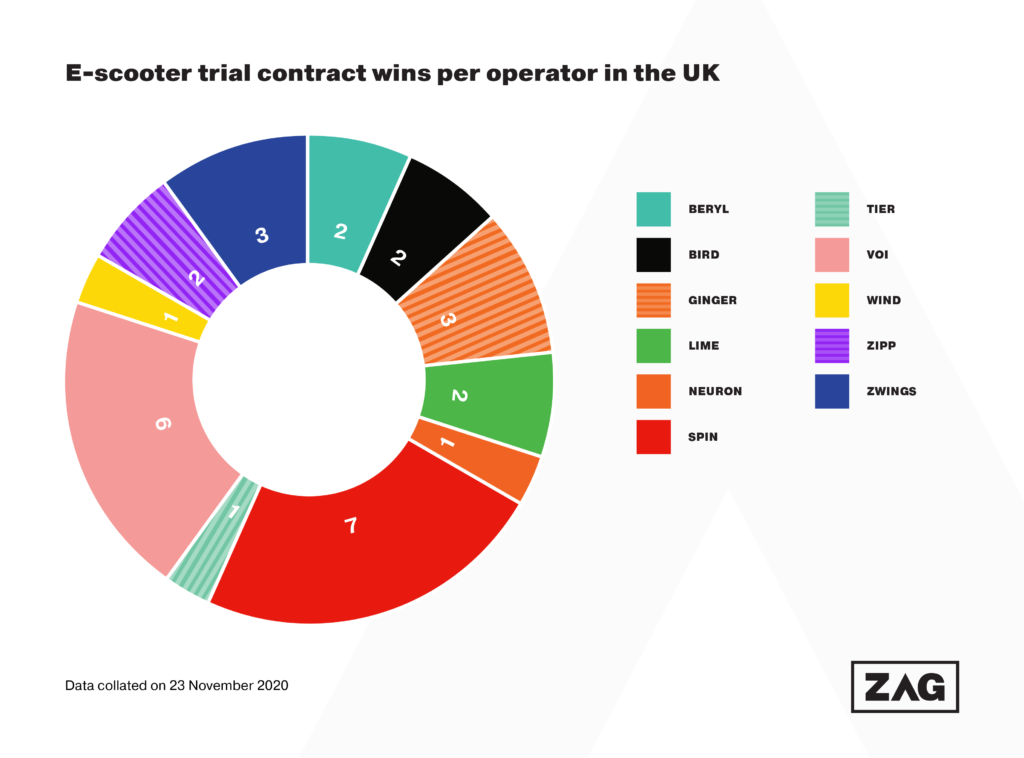

2: Pilot programme contracts won, by operator

Here, we see a much closer race, with Spin (with seven wins) edging out Voi with six). These two are both a long way ahead of their rivals.

We’ll say right away that this was a difficult data set to pull together. Some tenders were not published publicly and others were split into different lots.

We’ve treated tenders that incorporated multiple locations into single award (such as the West Midlands programme) as a one contract. Conversely, a contract split into multiple lots that could conceivably have been won by different operators (ie Essex) is counted on our chart multiple contracts.

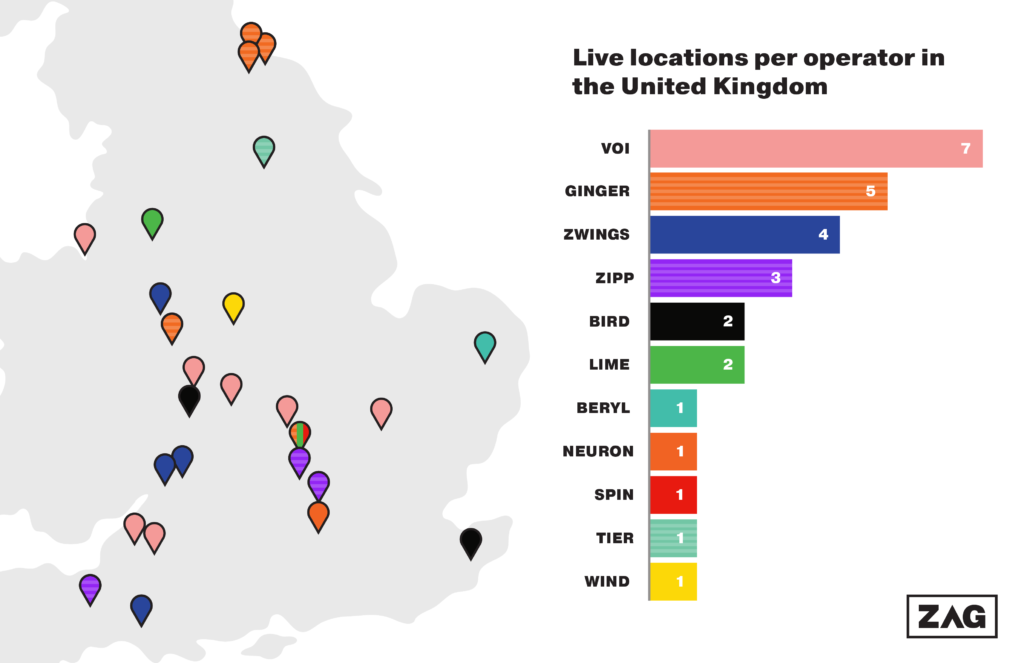

Perhaps the most straightforward way to get an idea of which companies are at work in the UK is to look at the number of trial locations that are actually live, by operator. Yes, we have a graph for that too.

3: Live trial locations, by operator

Compared to this first graph, this tells a different tale. Yes, Voi remains out front, but not by much. Spin falls to the back of the queue, with Essex locations not expected to come online for another few weeks. Ginger is cracking ahead with five locations (which, arguably, would be six, had Luton leaders not recently backed away from introducing a pilot soon).

What all three charts do show is just how powerfully the small start-ups have performed: Ginger, Zipp and Zwings have wiped the floor with the likes of Bird and Lime. Granted, those small operators have won smaller towns, for the most part, with small fleets. But when it comes to presenting to TfL, or Scottish cities, or Welsh cities, it’s these smaller companies that have demonstrable experience on British soil in multiple locations.

And then there are the companies eagerly eyeing the market and itching to get started here, such as Dott, Link and Bolt.

Think it’s all over? Oh no. This war is just getting started.

Additional reporting by Oliver O’Brien.